| Grandstanding Traction Is One Year Old! |

| 14 January 2008 |

With the end of 2007, it marked a year since Grandstanding Traction took up its mission and started posting on the trials and tribulations of Turkey's Private Equity and Venture Capital space. For a review of the Grandstanding mission, please visit our first post : Grandstanding Traction Objectives. While I have tried unequivocally to post on all dealflow, exits and fundraisings in Turkey, of course I have to apologize if there was not enough time in the day or manpower to get the reader the latest news.

Here's what I have noticed and changed about the site:

- Subscriptions: - Since the beginning, I have always included the RSS subscription button on the upper left corner, as well as a Feedblitz Emailer button on the right sidebar. As of this post, Grandstanding Traction has around 70 feed readers, 21 of which are Feedblitz email readers. As a publisher, I just want to thank you for your readership. Please feel free to pass it on to your friends, or don't be afraid to comment on all posts.

- Venture Capital/Private Equity Links: - One of the main reasons I started Grandstanding Traction was to have one source for all VC related Funds and Firms in Turkey or of those that invest in Turkey. I envisioned a place where entrepreneurs could come and be able to locate a VC and pitch their ideas. At this time, I might as well update this with a few more VCs and PE Funds:

- KOBI A.Ş. - A small fund of 20 million YTL paid-in capital, this fund is the funding arm of TTGV, the Turkish Technology Entrepreneurship Fund for legal reasons. So far they have three investments. Apparently, they want exits in 5 years.

- Le Venture - This fund appeared in the last year, with its partners based out of England and Germany. They just closed their first round of funding in July 2007 and partnered with the European Founders Fund of Germany. So far, they already have 5 investments in Turkish Internet companies.

- The Ottoman Fund - Though definitely not VC, and typically not private equity, The Ottoman Fund is a publicly traded fund on the AIM totally focused on real estate investment in Turkey. I provide a link simply because it represents foreign investment in Turkish projects (not to mention that they've taken a great name). I admit the real estate market in Turkey is booming, and the amount of interest in real estate investment trusts as well as shopping centers/commercial property merits its own site entirely. Unfortunately, due to time, I will try and slowly add these features to the site.

- Comments: - Over the last year, I have tried to put forth such topics that readers could comment on. Unfortunately, readers are either too intimidated or simply do not feel commenting is necessary - for that I apologize. In addition, if I failed to get all the facts, I ask my readers to please set the record straight either my emailing me or making a comment.

- Labels or Technorati Tags? - Since my first post, I have provided Technorati Tags at the end of each post so that the reader may simply click a tag and drill down on that topic at Technorati - a portal that ranks and indexes blogs. However, I cannot guarantee that the content you find on Technorati will be applicable or existant. For example, if I tag a post with "Mr. Joe VC", there may not be anything regarding him on Technorati. In addition, because of the pinging nature of Technorati and the Atom/RSS feed confusion of Blogger, Technorati has trouble updating its index. Some, this writer included, may even question Technorati's usefulness.

On the other hand, if the reader clicks the Blogger "Labels", you will successfully drill down to all other Grandstanding posts on that topic/subject.

- Search Grandstanding Traction (and/or all community links) with Lejit! - In the right sidebar, you will see the Lejit Search Widget. By typing in a search topic, you will not only successfully search all Grandstanding posts but also all websites in my community. This includes all VC sites listed on this page (Ask the VC, Feld Thoughts, Sortipreneur, etc.). Also, if you're curious about one of its "fairly pretty", but "somewhat useful" features, click "Explore" and see how Grandstanding Traction is connected. You, too, can add yourself by simply adding a Grandstanding Traction link to your blog or website.

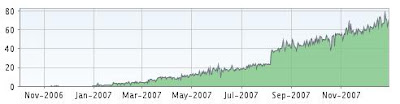

- Finally, Traffic... - What can I say? For a part-time blogger, there is nothing more satisfying than increased traffic/readership subscriptions and struggling to maintain the status quo. For those interested (on inquiry only), I can provide a more detailed analysis of my visitors, but for now, the breakdown is generally as follows:

This is a representation of IPs that resolve to static corporate/commerical domains, and therefore can be categorized and labeled. However, this only represents 20% of total traffic.

In conclusion, it has been a fun year. For the future, based on time permitting, I would love to continue updating with posts, but I would also like to add a podcast with interviews with industry professionals. So if you like that idea, please let me know. In addition, I've also started helping entrepeneurs find funding through various funds, - so for all entrepreneurs - keep sending me those business plans and powerpoints, and I will give you a free consultation, as I have for others in the past.

I have met a lot of wonderful people with contacts both in the international and Turkish PE/VC industries as well as entrepreneurs in and outside of academia. I look forward to meeting more of you and continually striving to support both entrepreneurs and PE professionals. Only through your support can Grandstanding Traction continue its coverage of the grandstanding of Turkish VC/PE professionals and the traction of the Turkish VC/PE industry. In addition, click here if you would like posts emailed to your inbox (through Feedblitz) - or - fed to your RSS readers via Feedburner.

Labels: Grandstanding Traction, statistics

|

|

|

|

|

| Turkey Launches iVCi - The Istanbul Venture Capital Initiative - a €200M Fund-of-Funds Aided by the EIF |

| 06 January 2008 |

Well, I finally get to break the news on this one since I only received the press release a few weeks ago. It is also fitting as it is Grandstanding Traction's first post of 2008. It should be a great year. The press release reads as follows:

.jpg) The European Investment Fund (EIF), together with the Technology Foundation of Turkey (TTGV), the SME Development Organisation of Turkey (KOSGEB) and the public Development Bank of Turkey (TKB) are jointly launching a target EUR 200m dedicated fund of funds and co-investment programme in Turkey. The Istanbul Venture Capital Initiative, or “iVCi” as the programme is known, aims to serve as a catalyst for the development of the private equity industry in this country whilst achieving good returns for its investors. iVCi is to be advised by the EIF. The European Investment Fund (EIF), together with the Technology Foundation of Turkey (TTGV), the SME Development Organisation of Turkey (KOSGEB) and the public Development Bank of Turkey (TKB) are jointly launching a target EUR 200m dedicated fund of funds and co-investment programme in Turkey. The Istanbul Venture Capital Initiative, or “iVCi” as the programme is known, aims to serve as a catalyst for the development of the private equity industry in this country whilst achieving good returns for its investors. iVCi is to be advised by the EIF.

iVCi further consolidates EIF’s risk capital activities in Turkey, where it already has invested in Actera Partners and Turkish Private Equity Fund II. EIF's Chief Executive, Francis Carpenter, said: "we are extremely proud of supporting and being advisor to this pioneering initiative in Turkey. We have first class local partners and are confident that iVCi will accelerate the development of a sector which is key to the development of the Turkish economy."

Sahir Cortoglu, TTGV's Secretary General, added: "this fund is a crucial starting point for formation of a risk capital market and culture which we believe will further serve as a means of technology development in Turkey" To this, Mustafa Colakoglu, Vice President of KOSGEB further commented "iVCi allows us to deliver to SMEs in Turkey top quality finance to support them reaching global markets through what has been historically an under-developed asset class in this country." Sahir Cortoglu, TTGV's Secretary General, added: "this fund is a crucial starting point for formation of a risk capital market and culture which we believe will further serve as a means of technology development in Turkey" To this, Mustafa Colakoglu, Vice President of KOSGEB further commented "iVCi allows us to deliver to SMEs in Turkey top quality finance to support them reaching global markets through what has been historically an under-developed asset class in this country."

TKB reflected on the importance of iVCi for the development of the domestic institutional investor base. Adbullah Çelik, Chairman of TKB said: "the majority of current institutional investors in Turkish private equity funds are foreign, iVCi provides a secure and sustainable environment for Turkish institutions, both public and private, to become involved as investors without hampering the corporate governance of the underlying funds." Currently, the majority of institutional investors in Turkish private equity funds are foreign based. iVCi shall provide access for its investors to the increasing number of Turkish private equity players. EIF is expected to invite a small select group of blue chip Turkish and international institutions to participate in this programme. TKB reflected on the importance of iVCi for the development of the domestic institutional investor base. Adbullah Çelik, Chairman of TKB said: "the majority of current institutional investors in Turkish private equity funds are foreign, iVCi provides a secure and sustainable environment for Turkish institutions, both public and private, to become involved as investors without hampering the corporate governance of the underlying funds." Currently, the majority of institutional investors in Turkish private equity funds are foreign based. iVCi shall provide access for its investors to the increasing number of Turkish private equity players. EIF is expected to invite a small select group of blue chip Turkish and international institutions to participate in this programme.

First closing of iVCi took place in Luxembourg on 13 November 2007 at EUR 150m. Official public launch is envisaged in the first quarter of 2008.

According to the AltAssets article on the iVCi release, the fund has a target of €200M. Also, according to Bankaciyiz - a Turkish bankers blog(in Turkish), the TKB will be contributing €10 million.

Hopefully, as this takes shape, we will see more venture capital partners and firms transpire in the area and finally grow this industry to fill the venture capital gap. It will be interesting to see what partners will take the reigns as well as what blue chip institutions will participate. I can't help but breathe a sigh of relief as this initiative gets started. I have always been somewhat negative as to the direction of the government in spurring innovation, more toward the universities and technoparks, and with the limited budgets that have been devoted, it has always been the case of very little funds locked up in bureaucratic steps. It was always the case of tax-free revenues that were suplemented by governement subsidies, which to me sounds like a company that could not survive in the real world. In addition, the universities somewhat lock incubated entrepreneurs up into "lifestyle" companies, and either continue to fund companies that should be cut loose, or maintain companies that should be growing at a greater pace if they had greater access to venture funds.

As an emerging market, Turkey made that choice of putting forward funds into univeristies and Technoparks, which isn't unwarrented given an economy that does not rely on its technology entrepreneurship. But in this case, Turkey can try to reinvent the wheel and sort of reverse engineer the process of spurring more innovation, entrepreneurship, greater job growth, growth of technology, value-add, and possibly even greater exports. Turkey is capable of creating world class companies. Again, as has been stated before on this blog, the education needs to begin. The TTGV and KOSGEB have all the tools to implement. Perhaps now it is up to univesity professors to refresh how they are training Turkey's entrepreneurs to access this capital.

Happy New Year Everyone!

[---+----+ Other Relevant News This Week +----+----]

Courtesy of the Turkish Daily News

Turkven Private Equity has acquired 70 percent of Provus Turkey and Provus Romania, the independent payment processor firm in Turkey and its operations in Romania for an undisclosed sum.

Buyers line up for Turk firms (Outlook for Foreign Mergers & Acquisitions in Turkey in 2008)

Turkey's Yildiz Holding has sold 60 percent of Fon Financial Leasing (FFK) to Kuwaiti-based Global Investment House KSCC (GIH), for $120 million.

Technorati Tags: Venture Capital, iVCi, Entrepreneurship, Fund Closings, Fundraising, Fund-of-Funds, EIF Technorati Tags: Venture Capital, iVCi, Entrepreneurship, Fund Closings, Fundraising, Fund-of-Funds, EIFLabels: Fund Closings, Fund of Funds, fundraising, iVCi, Venture Capital

|

|

|

|

|

|

|

|

|